Irrational? Yes, but there’s mileage however in Europe’s party

Traders are pushing markets to new highs in the encounter of worrying evidence that all is not well

When, in December 1996, Alan Greenspan asked his famous rhetorical question about investors’ capacity for self-delusion, the US stock market place had been increasing for six years.

Concerned that persistently low inflation was breeding unsafe complacency between traders, he asked the American Enterprise Institute “how do we know when irrational exuberance has unduly escalated asset values, which then become topic to sudden and prolonged contractions?”

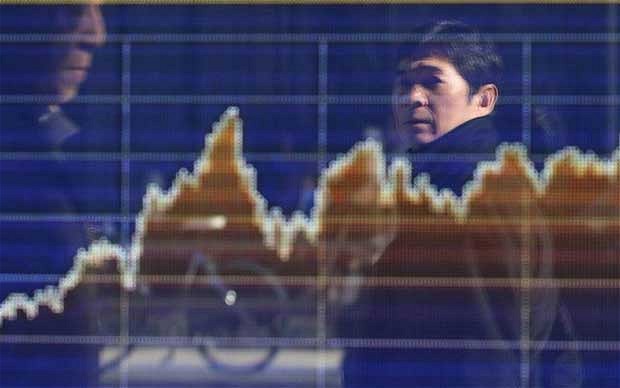

These days, markets have been growing for virtually as long and numerous individuals are beginning to inquire the very same query as the former Fed chairman. The trigger for complacency is a bit different – simple funds, not low inflation is offering the rocket fuel this time – but the end result feels related: traders are pushing markets to new highs in the face of worrying evidence that all is not well.

Nowhere is this much more evident than in Europe, the place stock markets have risen in a far more or much less straight line for the past two years. Up by about 50pc more than that period, they’ve a lot more than doubled considering that 2009.

European shares have accomplished this in the encounter of far more or much less non-existent economic development, dangerously reduced inflation, even now substantial unemployment, an uncompetitive currency and sliding corporate earnings expectations. If exuberance has ever been irrational it has absolutely in no way felt a lot more so than in Europe this week.

The past two many years have noticed a huge re-rating of European equities on the back of enhanced investor sentiment. But this has had nothing to do with improving final results for the region’s organizations. Expectations for earnings growth, the ultimate determinant of share costs, have pretty much halved since the beginning of the 12 months.

In terms of what has driven the growth in markets, it has been valuations of low quality and peripheral nation stocks, a sign that the gains are not the consequence of sustainable development but of relief at Armageddon deferred and hopes for a wave of US-design income printing.

Final week’s historic move by the ECB to stave off a Japanese-fashion deflationary slump sees Europe’s belated arrival at the straightforward-cash get together that the US, Japan and Britain have been enjoying for many years now. This will undoubtedly be excellent for risky assets such as shares in the short term.

The mixture of reduced development, minimal interest rates and minimal inflation has been great news for the owners of assets. They have got substantially richer given that the economic crisis, allowing them to reinvest their revenue in other economic assets, pushing rates ever larger.

In the many years soon after 2008, it was difficult to argue against this virtuous circle. Increased asset prices had been a needed prop to the international financial recovery and valuations had been so minimal increasing markets had been merely returning to normality.

It is much more difficult to argue that most financial assets are cheap right now. In some places they are quite hugely priced and in elements of the marketplace we are previously seeing indicators of extra. A single that stands out is the market in new listings, where the good quality of firms hunting to float is worryingly poor. It is no coincidence that each Neil Woodford and Fidelity’s Alex Wright warned in the past number of days that they are steering clear of most floats.

If you feel that this is a counsel of despair, even so, it is not. Or at least it is not nevertheless. The reason is that, as Mr Greenspan discovered in the three years that followed his speech, markets can detach themselves from fundamentals for extended periods prior to they collapse below their own weight.

One of the consequences of a new era of eurozone financial largesse will virtually certainly be an upsurge in corporate activity. A lot more takeovers will proceed to fuel the rising disconnect amongst share costs and earnings we have observed over the previous two many years in Europe.

This is an extremely unpleasant time to be an investor. But as Keynes rightly observed, the industry can remain irrational longer than you can remain solvent. This feels like a second to go with the flow.

Tom Stevenson is an investment director at Fidelity Worldwide Investment. The views expressed are his very own. He tweets at @tomstevenson63