Obamacare tax shock looming

Obamacare enrollees who obtained subsidies shortly will have to report their 2014 cash flow. They may possibly conclude up owing cash or obtaining a smaller sized refund.

The next Obamacare controversy is appropriate around the corner.

Obamacare enrollees who acquired subsidies to aid shell out for protection will quickly have to reconcile how considerably they truly earned in 2014 with how much they believed when they used a lot of, numerous months ago.

This will most likely guide to some extremely unsatisfied Individuals. These who underestimated their revenue possibly will receive more compact tax refunds or will owe the IRS money.

Which is because subsidies are in fact tax credits and are dependent on annual cash flow, but folks obtained their 2014 subsidy ahead of understanding specifically what they’d make in 2014. So you’ll have to reconcile the two with the IRS in the course of the impending tax submitting year.

It will not likely be surprising if numerous enrollees guessed wrong. The indication up time period started in October 2013 and a lot of folks did not know what they’d make in 2014. Some went off what they attained in 2012.

Also, it was up to customers to report main alterations in their conditions, this kind of as landing a new occupation or getting married, so their subsidy amounts could be recalculated.

We are not speaking chump change. These who utilized by means of the federal exchange received an regular month-to-month subsidy of $ 264, according to the most latest figures reported by the Obama administration. They only had to spend $ eighty two a thirty day period, on common, for coverage, Around eighty five% of total enrollees obtained support with insurance policies premiums . The administration last thirty day period stated 2014 enrollment was 6.seven million.

Those who underestimated their earnings could owe countless numbers of bucks, even though there is a $ 2,500 cap for those who continue being qualified for subsidies. The threshold for eligibility is based on income – $ forty five,900 for an personal and $ ninety four,200 for a family in 2014.

Of program, these who overestimated their 2014 cash flow might get a healthier-than-predicted refund. And some will see no modify.

Here’s what takes place next:

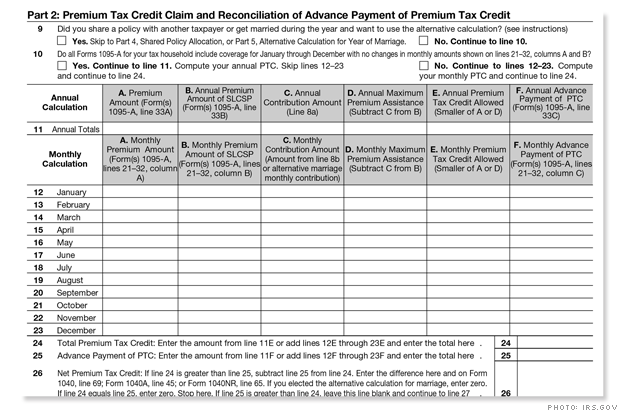

Obamacare enrollees ought to obtain Form 1095-A from their exchange by Jan 31. It lists who in the home had procedures and how a lot they obtained in month to month subsidies.

Taxpayers will then use that documentation to fill out Kind 8962, which asks specifics on insurance coverage, subsidies and income. If they were not lined for the whole 12 months, they have to break down the subsidy payments by thirty day period.

“It will be really difficult for these individuals who obtained quality tax credits to get ready their taxes on their possess and get this straight,” said Timothy Jost, a regulation professor at Washington and Lee College.

Also regarding is whether or not the Sort 1095-As will include precise details and no matter whether the exchanges will deliver them by the end of January, mentioned Jost, who writes about Obamacare for the Wellness Affairs site.

Trade officers interviewed do not expect there to be troubles with their file keeping. The federal trade is presently testing its procedure to confirm top quality and subsidy amounts with insurers to make positive can produce accurate tax types.

“Customers will receive their 1095-A from the [exchange] in the mail and it will be posted to their online healthcare.gov account for the duration of tax submitting year,” mentioned Aaron Albright, a spokesman for the Facilities for Medicare & Medicaid Services, which oversees the federal trade. If there are mistakes, they can go to health care.gov/taxes to get a corrected kind.

Lined California, the premier state-dependent exchange, expects to mail its varieties on Jan. 20, mentioned Dana Howard, the exchange’s deputy director of communications.

Buyers who have difficulty filling out their returns shouldn’t count on to get well timed aid from the IRS. The company experienced its funds minimize, and its commissioner lately explained it might only be in a position to reply just in excess of 50 % the telephone phone calls gained.

“Telephone calls will not be answered even as inadequately as they ended up previous year,” explained Roberton Williams, a fellow at the Tax Policy Heart.