Premium Bonds prize pool increases by 52,000

From following month the number of Premium Bonds prizes will improve by 52,000

There will be much more Premium Bonds winners from next month as the variety of prizes handed out is set to increase.

Government-backed National Cost savings & Investments, which gives the bonds, announced the tax-free of charge prize rate paid to traders will enhance from one.3pc to 1.35pc. The worth of Premium Bond prizes distributed will rise from £52m to £55.5m per month, with 52,000 further prizes paid out.

From August, a second £1m month-to-month jackpot prize will be won – some thing announced back in the March Spending budget by Chancellor George Osborne.

The arrival of this second prime-level prize sparked concern that unless of course the overall prize charge have been to rise, the amount of smaller would have to fall to compensate.

It seems NS&I has created the necessary adjustments to ensure the spread of prizes is unaffected. It mentioned “the variety of prizes in every single value group will improve or stay the same”.

There are 3 worth classes: “higher”, which covers the prizes £5,000, £10,000, £25,000, £50,000, £100,000 and £1m “medium”, which covers the two prize brackets of £500 and £1,000, and a “lower” group for the £100, £50, and £25 prizes. The latter are by far the most many, and account for around 90pc of the total payout by worth.

Following August’s alterations the odds of a £1 bond winning something in any month is also unchanged, at 1/26,000.

Cash has been pouring into Premium Bonds. This is not only simply because the typical prize charge, tax totally free, is not unattractive beside other, taxed accounts, but because in June the maximum sum any individual could invest in the bonds was increased from £30,000 to £40,000.

At the time of the boost NS&I stated inquiries were 30pc larger than normal. About 600,000 Premium Bond investors – out of a complete of much more than 21m – have invested the optimum.

NS&I was provided an additional enhance in Mr Osborne’s “budget for savers” when it was announced that from following year it would offer “pensioner bonds”. Number of details have yet been launched other than that the bonds will be for above-65s only, with terms of a single and 3 many years.

– Updates on Premium Bond alterations are integrated in our weekly e mail

What are Premium Bonds?

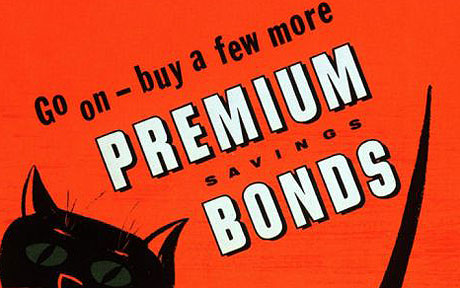

The lottery-design bonds were launched by Harold Macmillan’s government in 1956 and have because proved hugely common, regardless of the arrival of far larger lottery prizes in current decades.

Premium bonds played a massive function in NS&I’s wider, historic function of raising income from the conserving public as a more affordable substitute to raising finance on the capital markets.

Due to the fact Nationwide Financial savings, which beame NS&I, was a Government company it could grant particular tax standing to its cost savings goods – and so Premium Bond winnings have constantly been tax-totally free.

Map: is it less costly to live in the city or a commuter hotspot?